Unreliable internet connectivity affecting your GPay payments? Here’s a fix

India’s computerized installments foundation has developed much throughout the long term. We’ve come from swiping our charge and Mastercards at POS terminals to saving card subtleties and approving installments with OTPs. The greatest jump was the presentation of the Unified Payments Interface (UPI) by the National Payments Corporation of India (NPCI). UPI permitted clients to make a Virtual Payment Address (VPA) to be connected to an investment funds or current record. This decreased everybody’s endeavors to give a considerable rundown of record subtleties like IFSC codes. Not at all like NEFT and RTGS exchanges, you additionally didn’t need to trust that the cash will be moved.

UPI and Wallets acquainted the country with the idea of distributed (P2P) cash move. The moves toward set up the VPA were not difficult to follow, it was protected since it expected you to approve installments and it was straightforwardly connected to your telephone number.

Why disconnected UPI installments?

Maybe the greatest drawback of the help was that it required web network for to start the exchanges. We’ve encountered exchange disappointments in applications like Paytm, Google Pay, PhonePe and WhatsApp Pay when we lose web network on our cell phones.

While NPCI saw sort to determine this issue, it additionally saw the extent of carrying the P2P installments administration to residents in rustic regions. The public authority has been empowering many individuals from these region in the country to embrace setting aside their well deserved cash. To make its financial administrations more available, NPCI presented the disconnected technique for moving cash.

This will assist with utilizing a similar VPA even in regions where there’s low web network. It exploits the Unstructured Supplementary Service Data (USSD) structure. You might be know about the *121# orders. Likewise, *99# is the code you can dial to set up and empower UPI installments on the off chance that you believe you are in a region with feeble web network.

The most effective method to set up your disconnected UPI installment

Before you can start setting up the disconnected UPI installments, there are a couple of focuses to remember.

- You can utilize the versatile number you’ve enlisted with your bank.

- A charge of 0.50 per exchange will be required.

- The exchange sum limit is set at Rs 5,000 for every exchange.

In the event that you haven’t set up a UPI for your record, you can follow the beneath steps:

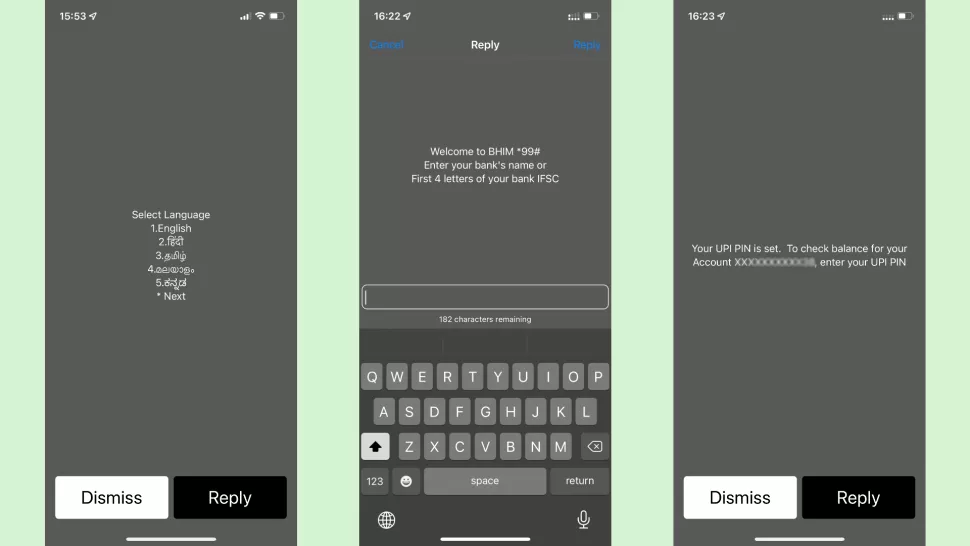

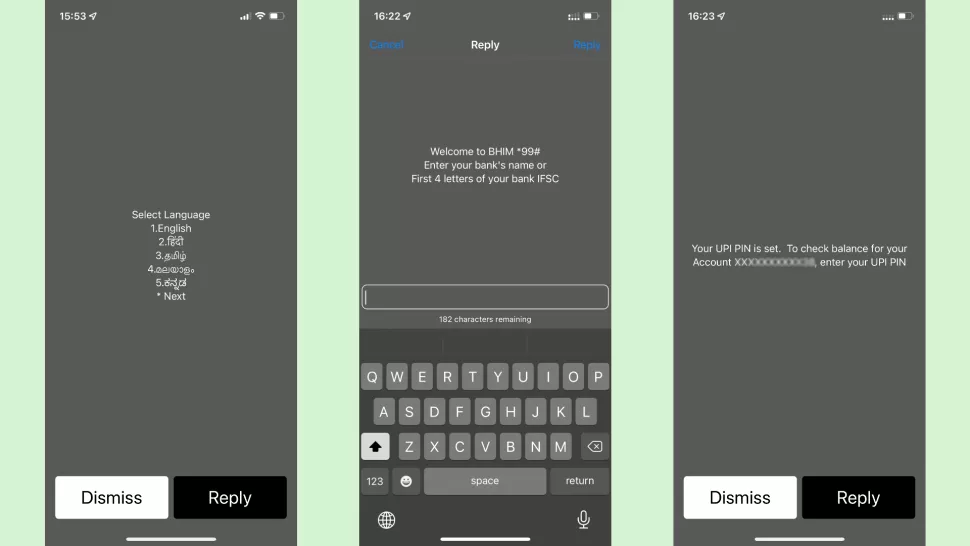

- Dial *99# utilizing your enlisted versatile number.

- Select your language from the menu.

- Enter the bank name or the initial four characters of the IFSC code

- Then, you would have to choose one of the records distinguished by the framework. It will show the initial 4 digits of the record number.

- Whenever you’ve chosen the record, you’ll be approached to include the last 6 digits of your check card.

- Post that, you should include the expiry date of the check card.

- Presently, you will be approached to set up your UPI Pin. This is crucial to approve installments going ahead.

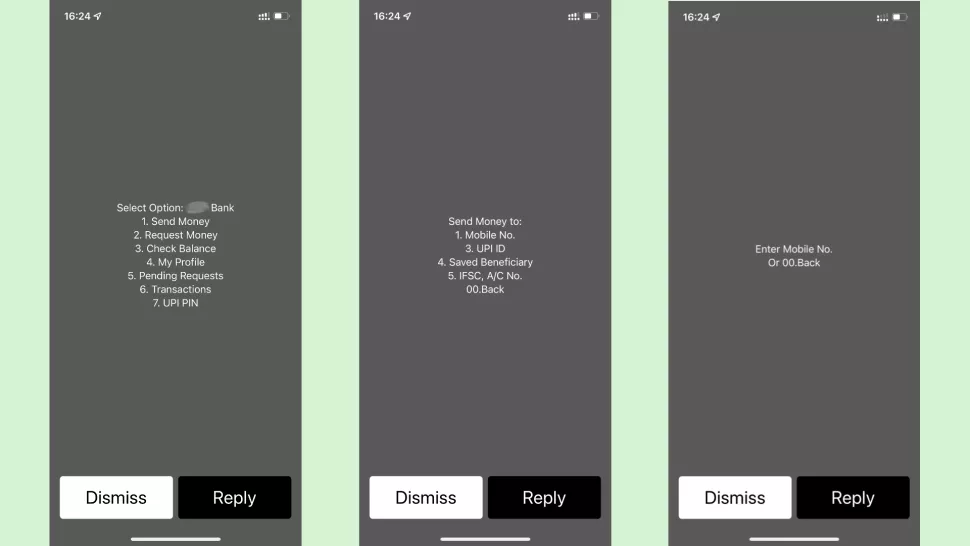

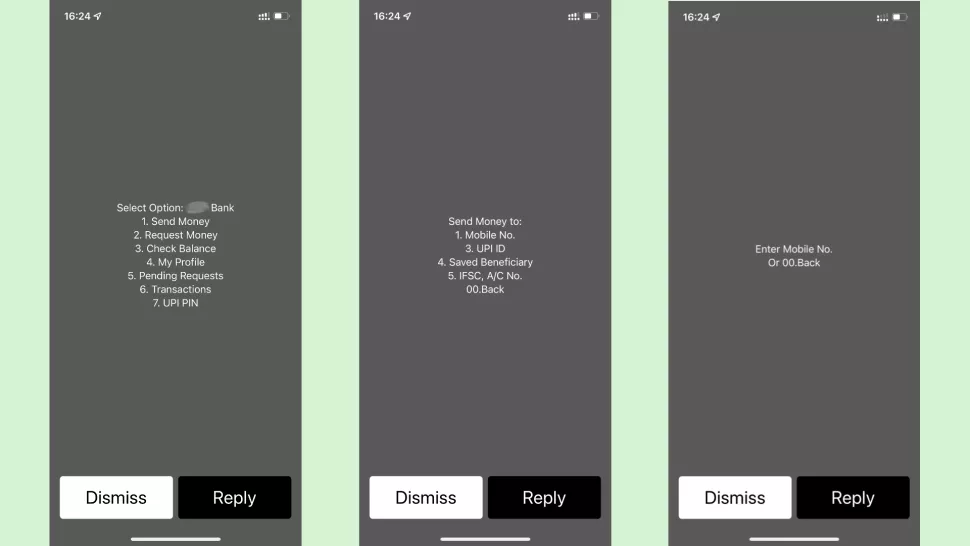

Now that the UPI is set up, you can dial *99# once more and will see another menu choice. This is how you really want to send cash:

- Select the primary choice.

- Then, input the UPI ID of the individual to whom you might want to move the cash.

- On the following screen, you should include the sum to be moved.

- Once submitted, you will be approached to enter the UPI pin you made.